So the year is almost over, but before it is over, now is the perfect opportunity to plan for the next year for your business. Although 2020 has been absolutely unpredictable, 2021 doesn't have to be that way. If 2020 has taught us anything, it is to be ready for the unexpected so your business will continue to thrive even during tough times.

With the global coronavirus pandemic impacting everyone, some businesses are opening up while many others are locking down. Even the accounting industry with a recent market research study by IBISWorld. They predict a marginal increase-perhaps even a lull in growth-for accounting firms for the rest of the year and the next. That is due to several factors, including:

- A decline in the demand for in-person services

- Firm closures due to health & safety precautions...with staff still on payroll,

- New competition entering the market.

As for us, we have always remained the same despite the pandemic. Talking to our clients frequently and on the phone or online through zoom. All without the need to meet in-person while following protocols on social distancing. Even through difficult times, we have continued being there for business owners out there who need to know critical data on their business with leading technology, blog, and youtube videos to not only survive but thrive. So don't worry, we update you on anything crucial so your business can adapt and evolve!

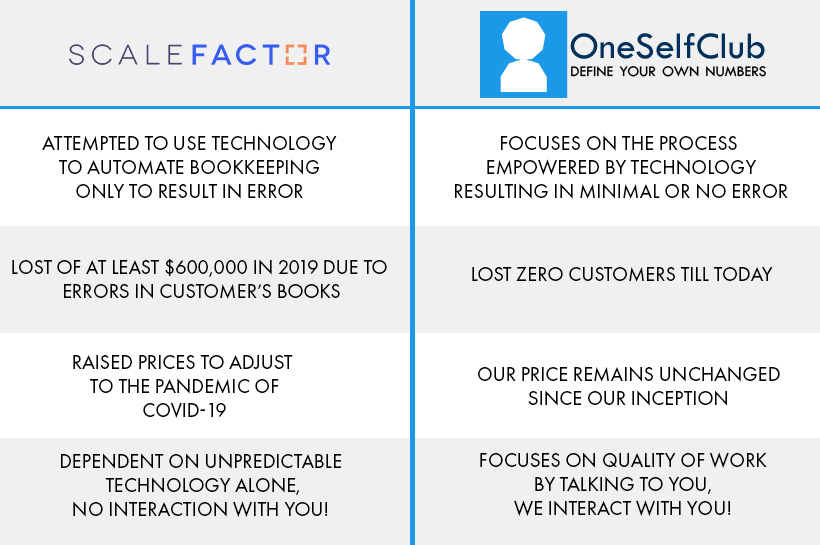

A once $100 million company that was going to be the next unstoppable juggernaut of their industry has fallen by the weight of self-inflicted problems. ScaleFactor was a technology-driven company that had developed a "groundbreaking" AI to do books for small business owners, however, in truth, it was completed by people. So when they took in an overabundance of small business owners who were ready to relax for the end of the day, not realizing the danger their company is going to be in when they find out that their books were going to be filled with errors. This eventually led to waves upon waves of cancellations, which was so bad it led to the loss of at least $600,000 worth of lost accounts in 2019. YIKES! That is a lot of cancellations. As ScaleFactor shuts down, they claim their failures on the current pandemic crisis of COVID-19.

While over here at OneSelfClub, we are currently thriving and growing despite the pandemic crisis! So why is that? We have a chart to share with you on the reasons why we're thriving and the BEST alternative to ScaleFactor:

Unlike ScaleFactor, we are not solely dependent on technology and we don’t leave you in the dark when things start to shakeup in the world. We want to talk to you, we want to make sure you understand where your business is at and plan to help your business prosper. And best of all, you can try us out to see if you like talking to us without any hassle, with a 30-day satisfaction guaranteed. We are here, ready to talk to you!

Managing cash flows can be challenging for businesses especially during this time. We have developed a tool that will empower you to understand your cash flow projection quickly for the next six months.

Our Cash Flow Runway Tool will help you understand your business projection and cash flow position instantly. Best of all, you have access to the tool 24/7 to make changes whenever you need.

With the Cash Flow Projection, it will calculate all of the data that was entered in to show you the projection of your business for the next six months.

Know how many days of cash you have left for your business with the Cash Flow Runway Days.

Insert cash at hand, avg monthly revenue, and one time infusions like loans to get correct and accurate projections.

Take control of your expenses and know where to cut unnecessary expenses. Make sure to insert the correct information for the best results.

Watch how you can use our cash flow runway tool to take charge of your financial position! The Pro version that is inside our video extracts data from your books (Xero or QuickBooks) into this tool so it is accurate and reliable. The Pro version is part of an all-inclusive accounting subscription with OneSelfClub. Sign up now to take advantage of this and more! Become a Pro with OneSelfClub Now!

The Paycheck Protection Program (PPP) is now in its second round of funding from the federal government's crisis aid for small businesses. However, many business owners are still waiting to receive this funding. To make matters worse, some lenders are prioritizing high-profile firms and clients. What do you do if your business gets rejected for PPP?

There are alternative options such as going through other funding options or even exploring the traditional EIDL (Economic Injury Disaster Loan), which is designed to help businesses through these tough times caused by the pandemic.

Business owners should also look into other alternatives or tax incentives such as the paid leave credit, the employee retention credit or even deferring payroll taxes. For example, the CARES Act allows you to defer your portion of social security (6.2%) within the period of 3/27 - 12/31/20. Interested to learn more about this subject, go to our webinar, learn more now!

Other than exploring your funding options, now is also a critical time to understand your numbers for your business. Knowing your numbers and making informed decisions based on your numbers is important during these tough times. Understanding your numbers empowers you to make timely decisions that would strengthen the foundation of your business. We have created a cash flow runway tool specific for business owners so you could utilize this tool to assess the level of your cashflows and what it takes for your business to survive.

Managing your cash flow is vital for your business during this pandemic. Now is the time to plan and prepare how to effectively manage your cash flow for your business. If you want to learn more about how to better utilize your cash flow, we're having a FREE webinar on how to manage cash flow during this pandemic. We'll show you how-to tips and tricks on how to effectively manage your cash flow so you and your business can survive this crisis.

If you have any questions or need help, please contact us today!